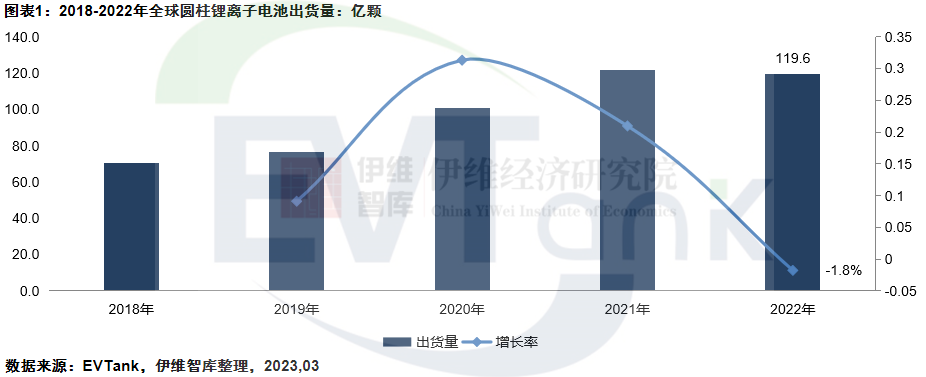

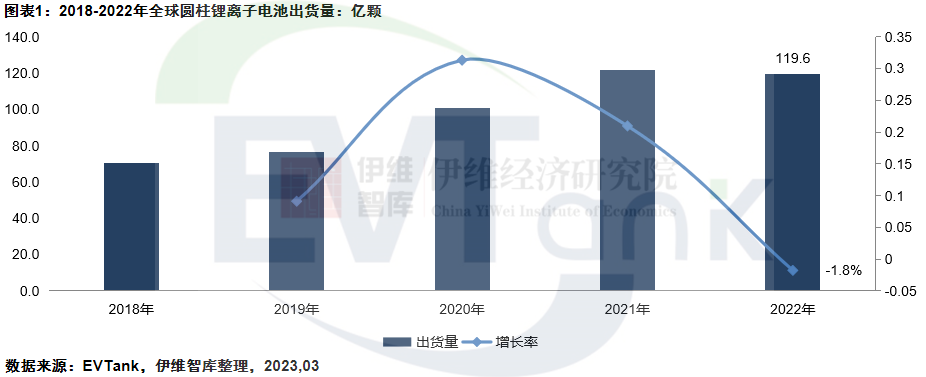

In 2022, the global shipment volume of cylindrical lithium batteries reached 11.96 billion units, with three major factors leading to a decline in demand

Recently, research institutions EVTank, Ivy Economic Research Institute, and China Battery Industry Research Institute jointly released the "White Paper on the Development of China‘s Cylindrical Lithium Ion Battery Industry (2023)". According to the white paper data, in 2022, the global shipment of cylindrical lithium-ion batteries decreased by 1.8% year-on-year to 11.96 billion units.

The white paper analysis suggests that the main reasons for the decline in global cylindrical battery shipments in 2022 are: (1) weakened demand for electric tools, resulting in a decrease in demand for high magnification cylindrical batteries, and the high shipment volume of electric tool batteries in 2021 has formed a large inventory in downstream tool manufacturers; (2) Ningde Times supplied Tesla with a large number of square batteries, resulting in lower than expected demand for LGES cylindrical batteries; (3) The high capacity cylindrical battery cells used in two wheeled vehicles, including battery swapping, have been replaced by low-cost square and soft pack batteries.

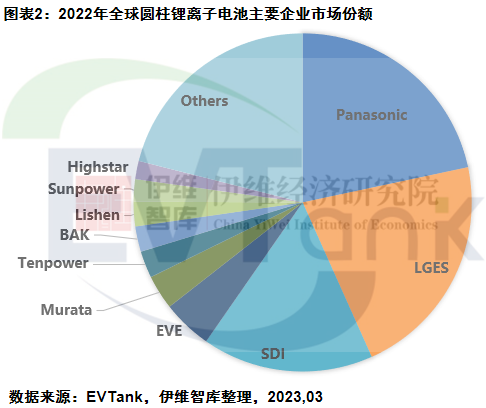

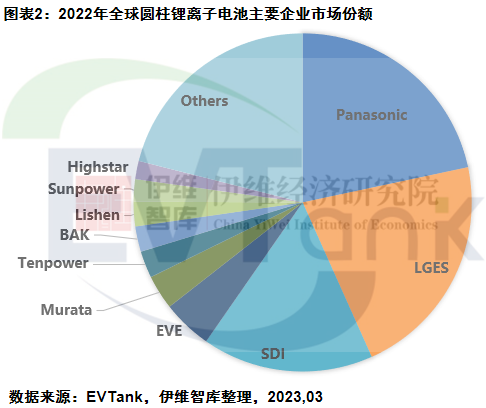

The white paper shows that the decline in downstream market demand has a much greater impact on Chinese companies than the four companies in Japan and South Korea. According to EVTank data, in 2021, the total global market share of cylindrical batteries by four Japanese and Korean companies was 51.5%, while in 2022, this figure increased to 63.0%. From the perspective of the shipment volume of each enterprise, the shipment volume of the four Japanese and Korean enterprises has maintained positive growth, with LGES ranking first with a year-on-year growth rate of 43.7%, while some Chinese cylindrical battery companies have experienced a rare year-on-year decline in their shipments. From the perspective of the competition pattern of the main cylindrical battery enterprises in 2022, the industry concentration ratio has further improved. The market share of Panasonic, LGES and Samsung SDI in Japan, South Korea in the cylindrical battery industry has increased from 48.9% in 2021 to 59.7% in 2022, especially the market share of LGES.

Ivy Economic Research Institute believes that the future growth of demand for cylindrical batteries will be mainly focused on automobiles and energy storage. Large cylindrical batteries, represented by 4680, 4695, etc., achieved small-scale production in 2022 and are expected to be shipped in large quantities in 2023, becoming the mainstream model for automobiles and energy storage batteries. The market growth rate of multiplier type tool batteries is relatively stable, and the opportunities mainly come from Chinese battery companies replacing products from Japanese and Korean companies.

From a supply side perspective, EVTank pointed out that due to the unexpected growth of the small cylindrical market in 2021, Chinese enterprises have expanded production on a large scale, forming a large amount of production capacity. The overall capacity utilization rate was at a relatively low level in the second half of 2022, and the inventory of cylindrical batteries in enterprises also reached a historical high in the second half of 2022.

In the white paper, Ivy Economic Research Institute also conducted a detailed statistical analysis on the different specifications, material systems, and shipment volumes of cylindrical batteries in different application fields. It also analyzed the regional competition pattern, technology route competition pattern, and competition pattern of different models and enterprises of cylindrical batteries.

For the main application areas of cylindrical batteries, EVTank has selected several key areas such as electric vehicles, electric tools, electric two wheeled vehicles, wireless vacuum cleaners, and electric balance vehicles for further detailed research, and has made forward-looking predictions for the future development trend of the cylindrical battery industry.